Info Lowongan Kerja Bank DBS Indonesia - Terbaru Update

Penting : Kami selalu berusaha menyajikan lowongan kerja yang menggunakan metode melamar secara ONLINE, seperti melalui Email, Website resmi perusahaan, E-recruitment, Portal lowongan kerja (Jobstreet, Kalibrr, dll.) serta Google Docs. Ini dikarenakan banyaknya pencari kerja atau yang biasa disebut dengan Jobseeker yang mengeluh karena melamar melalui Offline atau mengirimkan hardfile ke alamat perusahaan bisa menghabiskan uang mereka, seperti membeli amplop, nge-print dan biaya POS!

Bulan ini, Bank DBS Indonesia membuka lowongan pekerjaan berbagai posisi. Jika kamu sesuai dengan kualifikasi, diharapkan segera melamar sebelum lowongan ditutup. Informasi lowongan kerja yang kami sampaikan di bawah bersumber dari Website Official Karir Bank DBS (carees.dbs.com). Jadi kami pastikan lowongan kerja ini resmi dan pastinya GRATIS, tanpa ada pungutan biaya selama proses seleksi.

Didirikan pada 1989, dan menjadi bagian dari kelompok usaha DBS Group di Singapura, PT Bank DBS Indonesia merupakan salah satu bank yang telah berdiri lama di Asia.

Dengan 44 cabang dan 1.600 karyawan aktif di 11 kota besar di Indonesia, Bank DBS Indonesia menyediakan layanan perbankan menyeluruh untuk korporasi, usaha kecil dan menengah (SME), dan aktivitas perbankan konsumen.

Diakui sebagai “Best Wealth Manager in Indonesia” oleh The Asset dan “Best Foreign Exchange Bank in Indonesia” oleh Global Finance, DBS Indonesia juga merupakan penerima predikat ‘Sangat Baik’ untuk kategori Aset Rp50 Triliun sampai dengan di bawah Rp100 Triliun dari Infobank. Pada tanggal 10 Februari 2018, Bank DBS Indonesia mengambil alih bisnis Retail dan Wealth dari Bank ANZ Indonesia

Informasi Lowongan Kerja di Bank DBS Indonesia

Update : 08 Februari 2022

1. Collection Agent

Risk Management Group (RMG) is responsible for the development and maintenance of risk management and internal control frameworks. we provide independent review and challenge to business to ensure that appropriate balance is considered in risk/return decision. in additional, RMG is responsible for the monitoring and reporting on key risk issues of the Bank. To manage risk effectively and deliver strong financial performance, we invest significantly in our people and infrastructure

Responsibilities :

• Conduct calling to customer by phone according target assignment

• Implementation code of conduct in collection activity

• Remind customer that handle to make payment before due date

• Give information to customers accurately and clearly

• Inform to supervisor or manager to investigate the suspected/fraud account.

Requirements :

• Strata 1 (S1)

• Good communication

• Capable to operate computer

• Highly motivated and capable working in the team

2. Customer Retention Officer

Responsibilities:

• To provide one-stop customer service phone banking channel and to cross buy bank’s products and services through these means whenever the opportunity arises.

• To achieve individual goals & target & Service Levels of Customer Service Centre

• The incumbent is required to assist customers with various enquiries and requests

Requirements:

• Degree holder

• Good computer literacy and Proficient in MS Office

• Good communication skills in both written and verbal communication

• Ability to multi-task, Meticulous and resourceful

• Good listening skills; Patient, calm and passionate in assisting customers

• It will be advantageous if candidates have experience working in Call Centre, Banking, Financial, Retail or Customer Services related position

3. Direct Contract - Collection System Admin

Business Function

Risk Management Group (RMG) is responsible for the development and maintenance of risk management and internal control frameworks. we provide independent review and challenge to business to ensure that appropriate balance is considered in risk/return decision. in additional, RMG is responsible for the monitoring and reporting on key risk issues of the Bank. To manage risk effectively and deliver strong financial performance, we invest significantly in our people and infrastructure

Responsibilities

1. Execute the testing in UAT system, perform Live Verification within implementation deadline for collection system enhancement /initiatives.

2. Execute user requests in collection systems within agreed timeline.

3. Ensure the completeness and availability of infrastructure asset for Consumer Credit Department (Credit and Collection).

4. Ensure the readiness and stability of collection systems during business hours.

Requirements

•Bachelor Degree from reputable university, IT/Economic background

•Highly motivated, self-driven, able to work without close supervision, making decision and strong control attitude

•Good teamwork

•Experienced in the banking system.

4. Officer, Fund Accounting Staff

Responsibilities

- process instruction given by investment manager on timely manner

- entry the instruction into FA system then run Valuation report that will be send to Investment Manager.

- Make sure the cash is sufficient before process instruction from Investment Manager.

- ensure all the regulatory report is submit on time.

Requirements:

•Demonstrated analytical skills

•Demonstrated organizational skills.

•Ability to work under pressure.

•Microsoft office

5. AVP, Business Compliance, Corporate Banking

Business Function

Group Legal, Compliance & Secretariat ensures that the bank's interests are protected by zealously guarding and enhancing its reputation and capital. We also work to maintain a good standing with all our regulators, customers, and business partners. Because we believe that at the heart of business banking is to uphold the values of trust and integrity for all our stakeholders.

Responsibilities:

1. to ensure related units correct understanding of laws, regulations, and bank's compliance standards

2. If there is any new regulation, to identify and address compliance gaps to ensure that the unit can implement the regulation properly and timely

3. to review Bank's policies and standards to ensure compliance to the prevailing regulations

4. to assist in dealing with regulators and regulatory matters, including seeking clarification on issue when required

5. to provide advices to related units regarding each initiatives whether it has been in line with prevailing regulations

6. to conduct training and prepare the necessary presentation

7. to prepare various presentation/ report for Management/ Committee reporting purpose

8. to provide evaluation from regulatory perspective for all communication materials provided to customer

9. from time to time conduct any assignment as required by the company

Requirements

•Bachelor Degree from reputable university

•Good communication and interpersonal skills

•Highly motivated, self-driven, able to work without close supervision, making decision and strong control attitude

•Proficient in English language

•Good understanding of Central Bank and Financial Service Authority requirement related to risk management.

6. Masih ada beberapa posisi lainnya bulan ini

Link Lamar >> careers.dbs.com

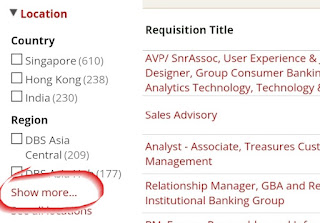

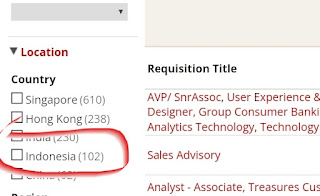

- Pilih Show more... ATAU See All Location, kemudian cari Indonesia

- Country pilih Indonesia

*Lowongan di atas bisa tutup sewaktu - waktu apabila posisi sudah terisi

𝗖𝗔𝗧𝗔𝗧𝗔𝗡 :

1. Kami hanya share ulang lowongan kerja ini dari sumber yang terpercaya.

2. Lowongan kerja ini GRATIS, tanpa dipungut biaya.

3. Selalu waspada terhadap segala bentuk penipuan.

Sekian informasi yang dapat kami sampaikan mengenai lowongan kerja di Bank DBS, Jika kamu sesuai dengan kualifikasi segeralah melamar, Jika tidak sesuai janganlah menyerah, tetaplah semangat mencari pekerjaan impianmu. Jangan lupa beribadah dan berdoa karena rezekimu sudah ada yang mengatur. Jika ditolak olah satu perusahaan berarti memang bukan rezekimu untuk bekerja di sana, Tuhan sudah menyiapkan rezeki yang lain, yang lebih baik untukmu.